Power of Science and Technology: The semiconductor market may recover this year, what are the opportunities in China?

In early February, SMIC and Huahong Semiconductor both released their 2023 performance reports. From the performance perspective, the semiconductor industry is still in a downward cycle, but looking ahead to 2024, both companies believe that it is expected to be better than 2023.

It is very appropriate to summarize the situation and response of China's semiconductor industry in 2023 with the four words "rising with the tide".

It is the subtitle of the first part of William Manchester's immortal masterpiece Glory and Dream. Different from the usual superficial optimism, Manchester's delicate description of "rise to the occasion" points to the resilience and change of American society in the extremely difficult situation of 1932-1941.

In 2023, as a hub for global electronic product manufacturing and circulation, China imported a total of 479.5 billion integrated circuits, a decrease of 10.8% compared to 2022; The import amount was 349.4 billion US dollars, a year-on-year decrease of 15.4%.

Even considering some domestic substitution factors, such a decline is enough to reflect the current global semiconductor industry's "big climate": the semiconductor industry's downward cycle that has been running through since 2022.

At the same time, China's semiconductor industry is also facing additional impacts from the geopolitical "microclimate". In October 2022, the United States introduced a semiconductor export control policy to China, which launched an unprecedented blockade on the import of high-end semiconductor equipment and high computing power chips in China. In 2023, it further intensified, and even saw the operation of "window guidance" to stop the export license of ASML lithography machines to China before the effective date, providing new vivid annotations for the so-called "free trade", "market economy", and "rule of law society".

On August 9, 2022, Beijing time, US President Biden signed the Chip and Science Act of 2022 (referred to as the "Chip Act"), with senior executives from companies such as Intel, Micron, HP, and AMD attending the signing ceremony. Image source: Pengpai News

Under such dual pressures, the Chinese semiconductor industry is likely to feel "not very good" in 2023. The chill of layoffs and salary cuts in the industry is rolling towards workers, and even semiconductor company founders/investors are facing a series of difficult tests such as tightening listing financing channels, sliding valuations, tight cash flow, and triggering betting agreements.

Some start-ups in the "big chip" market, such as GPUs (graphics processing units), have experienced substantial shutdowns in 2023 due to high valuations, large financing scales, and geopolitical risks when their products were launched. As for semiconductor design teams that seem to rely on "big factories" for peace of mind, as the parent company's resources focus on the main channel and cut off nutrient supply, explosive cases of "sudden death" have also emerged last year, such as Zheku, Moxin, and Furui Micro.

However, setting aside these diverse individual feelings, from the perspective of macro data, China's semiconductor industry still shows commendable growth resilience, making significant progress in operation and development quality.

According to data from the National Bureau of Statistics, in 2023, China's domestic integrated circuit production reached 351.4 billion pieces, a year-on-year increase of 6.9%. The semiconductor industry ecosystem has further improved, and the domestic substitution of mature process chips has become a trend.

In addition, according to Jibang Consulting, at least 350 investment projects in the semiconductor field in mainland China are accelerating throughout the year, including more than 100 signed projects, more than 90 projects that have started, more than 50 operational projects, and more than 50 projects that are about to be completed, covering third-generation semiconductors, storage chips, automotive chips, advanced packaging, sensors, RF chips, silicon wafers, semiconductor equipment materials, and other fields.

Especially in the power semiconductor market, China's industrial chain has initially formed global competitiveness, and some emerging tracks such as silicon carbide (SiC) and gallium nitride (GaN) devices have even achieved parallel or even leading positions with international standards domestically.

With the steady progress of major industrial projects, as an important indicator of industrial capacity in the semiconductor field, it is expected that by 2025, China will lead the world in expanding the manufacturing capacity of 200mm (8-inch) wafers, and the proportion of production capacity of 300mm (12 inch) wafers in the world will also increase to 23% at that time.

Image source: Pixabay

It is also worth noting that China's semiconductor industry made significant progress in overcoming many difficulties and bottlenecks last year.

The government should formulate integrated circuit industry policies that are in line with national conditions and new situations, set pragmatic development goals and ideas, help enterprises coordinate and solve difficulties, play a good organizational role in areas of market failure, and guide long-term investment.

At the same time, it is necessary to attach great importance to the important role of market forces and industrial ecology, establish a research and development mechanism with enterprises as the main body, rely on entrepreneurs to achieve the healthy development of the integrated circuit industry, especially be good at discovering and cherishing leading talents who understand technology and have strong organizational capabilities, and give them full play space.

Shortly thereafter, a series of major institutional and mechanism reforms in the field of science and technology, such as the establishment of the Central Science and Technology Commission and the reorganization of the Ministry of Science and Technology, were made public. The outside world generally regarded them as targeted measures to strengthen centralized and unified leadership in key areas such as semiconductors, coordinate the promotion of the new national system, and achieve technological self-reliance and self-improvement.

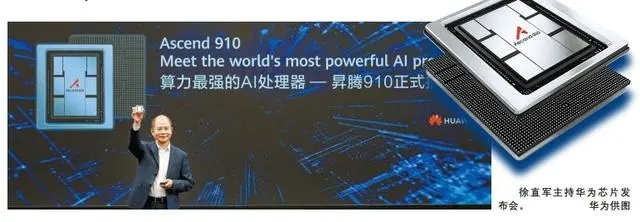

As mentioned earlier, in the US semiconductor technology blockade against China, high computing power chips and advanced process equipment can be considered two key factors. After encountering a crazy siege that can be described as stormy waves, the Chinese semiconductor industry has stabilized its position in 2023, and with the emergence of Huawei MATE60 as a symbol, it has issued an indomitable dragon chant to evil.

To this day, although the actual supplier of the Kirin 9000 processor is still an unsolved mystery, it is an undeniable fact that China has advanced process chip manufacturing capabilities that are not under the jurisdiction of the United States. After experiencing the "flash sale" of lithography machines in 2023, the independent guarantee ability of domestic chip manufacturing is expected to be further improved.

Renowned semiconductor industry analyst Dylan Patel bluntly stated that US semiconductor export controls on China have "failed" after analyzing the technological level of the Kirin 9000. According to Patel's assessment, the Kirin 9000 is unbelievable in terms of technology, comparable to Qualcomm's best baseband chip performance, and its manufacturing process is also better than most people in the West realize. "We cannot exaggerate how terrifying this is." In Patel's view, the greater significance of China's advanced process chip independent production capacity lies in breaking through the AI computing chip blockade deliberately created by the United States.

With the explosive growth of the AI big model business ecosystem last year, advanced process and high computing power chips used for big model training have been recognized as having strategic and global value in AI computing power competition. Nvidia has also surpassed a trillion dollar market value with its product advantages in this field.

US policy makers firmly believe that as long as high-end GPU acceleration cards such as NVIDIA H100/A100 are blocked from exporting to China, it will be enough to firmly suppress China's AI industry in the "medium technology trap" and gradually be separated from the US AI industry, winning without a fight in the competition for this strategic emerging technology high ground. However, the advanced process chip production capability demonstrated by the Kirin 9000 is considered sufficient to theoretically support the supply of over 10 million Nvidia H100 grade GPU (graphics processing unit) chips annually. Even in the face of strict lockdowns, Chinese institutions will soon have a computing power cluster to train trillion parameter large models.

Moreover, it is not difficult to understand with a slight understanding of the actual construction of computing power clusters. The high-profile large chips of American manufacturers such as Nvidia are like blocks of green bricks. Only by following reasonable steps and planning can they become the foundation of the city. Even if the quality of the bricks in the hands of the Chinese people cannot reach the most perfect level, through reasonable system integration optimization and stronger adhesives (computing power cluster network communication technology), the overall capabilities can still be achieved in tandem.

According to the understanding of the Science and Technology Force, the construction and debugging of 6 thousand card clusters and even 10 thousand card clusters based on Huawei's Ascension chips are currently underway, which will be sufficient to support the training requirements of parameter models at the level of billions or trillions in the future. With Huawei's self-developed UB interconnection technology and the strong alliance of next-generation AI computing chips, it is also expected to define a new value competition track for AI computing clusters. Clusters with over 100000 cards are not impossible.

Image source: Shenzhen Business Daily

In terms of advanced process technology equipment, lithography machines are undoubtedly the most eye-catching focus at present. Although immersion lithography machines purchased from overseas can stabilize China's advanced process chip manufacturing capabilities in the short to medium term, the fundamental solution is still to independently innovate domestic lithography machines.

In 2023, news about the so-called offline delivery of 28 nanometer lithography machines was overshadowed, but the objective system manufacturer Guowang Optics Factory was capped at the end of last year, providing ample confidence to the outside world. It is only a matter of time for Chinese people to break through high-end DUV lithography machines, and the public opinion turmoil of the EUV "lithography factory" during the same period reflects the earnest expectations of overseas people for EUV lithography machines.

Objectively speaking, the breakthrough of EUV lithography machines is still far away, which also poses an insurmountable high wall of 5 nanometers for the current iteration of advanced semiconductor process technology in China.

However, even if the US and Western camps have EUV lithography machines, the mass production cost of process nodes below 5 nanometers is still enough to deter the vast majority of chip manufacturers. The championship style technical parameter comparison lacks practical significance. From architecture innovation such as RISC-V (Open Source Instruction Set Architecture) to the advanced packaging technology paradigm of Chiplet (Chip), the development of high-performance chips is not only limited to Huashan. In the emerging technology trend, the gap between the Chinese industry university research and application community and the US and Western camps is far smaller than the traditional technology path.

On the whole, the baptism of 2023 is clearing away the painful and necessary foam for China's semiconductor industry. It will be more healthy when speculators are washed out and eliminated. At the same time, the market cycle is finally approaching a turning point. The World Semiconductor Trade Statistics Organization (WSTS) recently raised its global semiconductor sales forecast, with global semiconductor industry sales increasing by 5.3% year-on-year in November, marking the first annual year-on-year growth since August 2022.

Glory and dreams will surely bloom after the wind and rain.

Please first Loginlater ~