The semiconductor industry chain is thriving, and opportunities in this niche field cannot be ignored

In recent years, with the rapid development of fields such as smartphones, the Internet of Things, and artificial intelligence, the demand for semiconductor materials has been continuously increasing. Especially driven by 5G technology, the global semiconductor industry has ushered in a new round of development opportunities. According to relevant statistical data, the global semiconductor market size reached 130 billion US dollars in 2019 and is expected to grow to 170 billion US dollars by 2024.

In the strong development process of the semiconductor industry chain, new semiconductor materials have also formed a rising trend, and their development prospects and investment value have also attracted market attention. Market analysts say that as upstream players in the semiconductor industry chain, the importance of semiconductor materials and equipment is self-evident. In recent years, China has made efforts to achieve independent and controllable development in the field of semiconductor materials and equipment, gradually realizing domestic substitution, which is of great significance and is a semiconductor sub sector worthy of special attention.

Against the backdrop of the ups and downs of the stock market this year and the rapid rotation of sectors, highly transparent and low-cost indexing tools have become a powerful tool for investors to seize various opportunities. The CSI Semiconductor Industry Index has a high allocation weight in semiconductor materials and equipment. The Huaxia CSI Semiconductor Materials and Equipment Theme ETF Link Fund (referred to as Semiconductor Materials ETF Link, Class A: 020356, Class C: 020357), which closely tracks this index, is currently in its issuance period, providing investors with a favorable tool for one click layout of the semiconductor industry chain.

Dual drivers of industrial benefits: demand expansion and domestic substitution

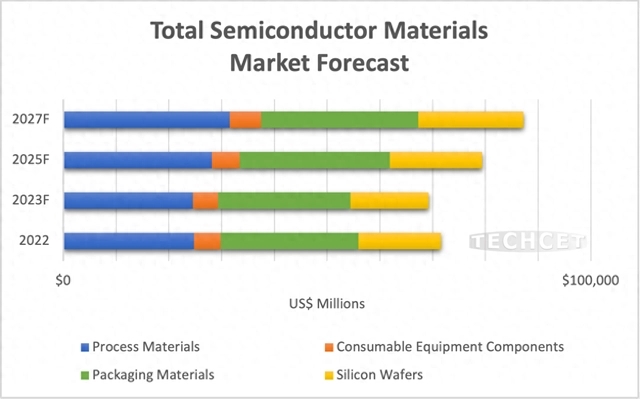

With the rapid development of the global technology industry, the semiconductor material market has maintained a high growth trend in recent years. TECHCET, an electronic materials consulting firm that provides semiconductor supply chain business and technical information, pointed out that due to the overall slowdown in the semiconductor industry and a decrease in wafer production, the market shrank by 3.3% in 2023, followed by a rebound. It is expected that the semiconductor material market will rebound in 2024, growing by nearly 7% to reach 74 billion US dollars.

Looking ahead, TECHCET expects the semiconductor material market to grow at a compound annual growth rate of over 5% from 2023 to 2027. The institution predicts that by 2027, the market will reach $87 billion or more, and an increase in global wafer fab production will bring potential for a larger market size.

From the perspective of the domestic market, Open Source Securities pointed out that from 2020 to 2022, China's semiconductor equipment investment has remained the world's largest for three consecutive years. At the same time, China plans to add the largest number of wafer fabs in the world. According to SEMI statistics, from 2021 to 2023, mainland China plans to build 20 new wafer fabs, ranking first in the world, and these new wafer fabs mainly produce 12 inch (300mm) wafers. In 2022, the market share of 300mm front-end wafer fabs in mainland China will be 22%. According to current capacity planning, SEMI predicts that by 2026, the global market share of 300mm wafer fabs in China will reach 25%, surpassing South Korea to become the world's number one, which will significantly drive the growth of China's semiconductor materials market.

In recent years, China has continuously attached great importance to the safety and development of the semiconductor industry, providing support to related enterprises through various forms such as policies, scientific research special funds, and industrial funds. Among them, the China Integrated Circuit Industry Investment Fund (also known as the Big Fund) is one of the most concerned support methods in the capital market. The first phase of the large fund raised 138.7 billion yuan, mainly invested in fields such as wafer foundry and packaging testing; The second phase of the large fund raised 204.15 billion yuan, mainly invested in the fields of semiconductor equipment and materials. At present, the development of domestic semiconductor material enterprises is in line with the construction progress of wafer foundries, which will further accelerate the process of domestic semiconductor material substitution. The long-term growth value of related enterprises cannot be ignored.

Highlighting Index Value: Focusing on the Upstream Prosperity of Semiconductors

The CSI Semiconductor Materials and Equipment Theme Index (code: 931743. CSI), which focuses on the semiconductor materials and equipment field, selects 40 securities of listed companies in the Shanghai and Shenzhen markets that involve semiconductor materials and equipment as index samples, reflecting the overall performance of securities of listed companies in semiconductor materials and equipment in the Shanghai and Shenzhen markets.

In addition to the CSI Semiconductor Materials and Equipment Theme Index, there are currently four semiconductor theme related indices in the A-share market, namely the CSI All Index Semiconductor (H30184. CSI), China Semiconductor Chip (990001. CSI), Chip Industry (H30007. CSI), and Science and Technology Innovation Chip (000685. SH). Although there are differences in the compilation rules and sample space of these four indices, most of their constituent stocks cover the entire semiconductor industry chain, including the semiconductor industry, design, materials and equipment, and testing and packaging, with high industry distribution similarity. Based on the third level industry of Shenwan, the weight of the above four indices in the chip design process is about 40%.

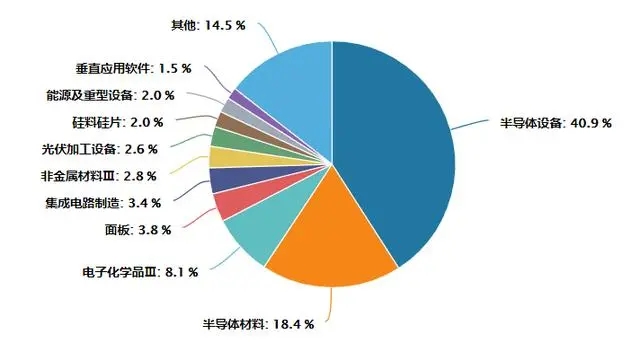

Compared to the industry weight allocation of constituent stocks in the four indices mentioned above, the CSI Semiconductor Materials and Equipment Theme Index focuses more on the materials and equipment links in the semiconductor industry chain. According to the third level industry classification of Shenwan, semiconductor equipment (40.9%) and semiconductor materials (18.4%) account for a high proportion in the semiconductor materials and equipment index, with a total weight of nearly 60%. They have a high concentration and can effectively represent the overall development trend of the industry; The top ten constituent stocks in the index mainly cover the leading targets of semiconductor materials and equipment, with a total weight of over 50%, which is in line with the overall characteristics of the index, and the overall investment value is clear.

Data source: Wind, deadline: December 25, 2023

From a historical perspective, according to Wind data, as of December 25th this year, the CSI Semiconductor Materials and Equipment Theme Index has accumulated a yield of 196.14% since its base date (December 28th, 2018), significantly outperforming the CSI All Index Semiconductor Index with a year-on-year increase of 124.58% and significantly surpassing the Shanghai and Shenzhen 300 Index with a year-on-year increase of 11.94%. The advantage in cumulative yield is relatively obvious.

From the current point of view, data from the same period shows that the price to earnings ratio (TTM) of the semiconductor materials and equipment index is 38.41 times, which is in the percentile of 11.37% since the index base day; At the same time, the market to sales ratio of the index is 3.36 times, which is in the 2.35% percentile since the base day. Currently, the risk premium of the index is in a relatively low historical range, and the rebound space and investment cost-effectiveness are relatively obvious. At present, there may be a favorable opportunity to layout semiconductor materials.

Investment in high-quality leading enterprises: supported by a first-class investment research team

In the market environment of style differentiation and sector rotation this year, index funds have become a powerful tool for more and more investors to capture market trends. Fund managers have been deeply cultivating the subdivision track and constantly innovating, promoting the scale of non commodity ETFs to exceed 1.5 trillion yuan by laying out theme index products. Emerging index products such as semiconductor material ETF connections (Class A: 020356, Class C: 020357) aim to fill market gaps by expanding into untapped niche areas, striving to gain competitive advantages through differentiated products, and providing more configuration opportunities for various market participants.

For investors, the high-tech field of semiconductor materials and equipment has high barriers, and the market capacity is constantly expanding. If investors invest directly in stocks, they will face significant selection costs, transaction management costs, and concentration exposure risks. Therefore, for small and medium-sized investors, choosing index funds to participate in stock market investment is undoubtedly a better choice. Index fund products, including semiconductor material ETF connections (Class A: 020356, Class C: 020357), typically have multiple advantages such as convenient investment, low fees, high transparency, and risk diversification, thus gradually gaining favor from investors. The investment strength of fund managers has become an important consideration for investors in asset allocation.

As a leader in the field of public index investment, Huaxia Fund's Quantitative Investment Department, established in 2005, is the earliest independent quantitative investment team in the industry. Through continuous innovation and development, it has achieved remarkable results, and its investment research strength has also been recognized by authoritative institutions. As of the end of the third quarter of 2023, the management scale of equity ETF products under Huaxia Fund exceeded 370 billion yuan. It is not only the only fund company in China that has been leading the industry in terms of equity ETF scale for 18 consecutive years, but also the only fund company in China that has been awarded the "Passive Investment Golden Bull Fund Company" award for seven consecutive years. Its ETF products have won 17 industry awards, including the Gold Fund Award and the Golden Bull Fund Award.

For a long time, Huaxia Fund has been committed to becoming the best index product service provider in China. Its ETF product line is becoming increasingly complete, covering various types of ETF products such as industry, theme, wide base, cross-border, etc. It also comprehensively lays out over-the-counter indexes and index enhancement products, which are highly favored by investors. After 18 years of dedicated development, Huaxia Fund has formed a profound accumulation in the field of index investment research. At present, the Huaxia Fund Index team is composed of more than 20 professional investment managers and dedicated researchers with years of rich experience at home and abroad. They have first-class index product development and investment management capabilities in the industry, and will jointly provide support for the new index product - Semiconductor Materials ETF Link (Class A: 020356, Class C: 020357).

Please first Loginlater ~